How to use ESG standards to build an environmental strategy

ESG standards for Environmental Practices

While ESG regulations and compliance requirements have not been formally established in the United States, corporations can leverage existing ESG standards and frameworks to build effective environmental practices in an overall ESG program.

There are a dozen unique ESG standards and frameworks in use across the globe today; however, in this article, we’ll focus on the three most common ESG standards applied in the United States for environmental practices: SASB, TCFD, and GRI.

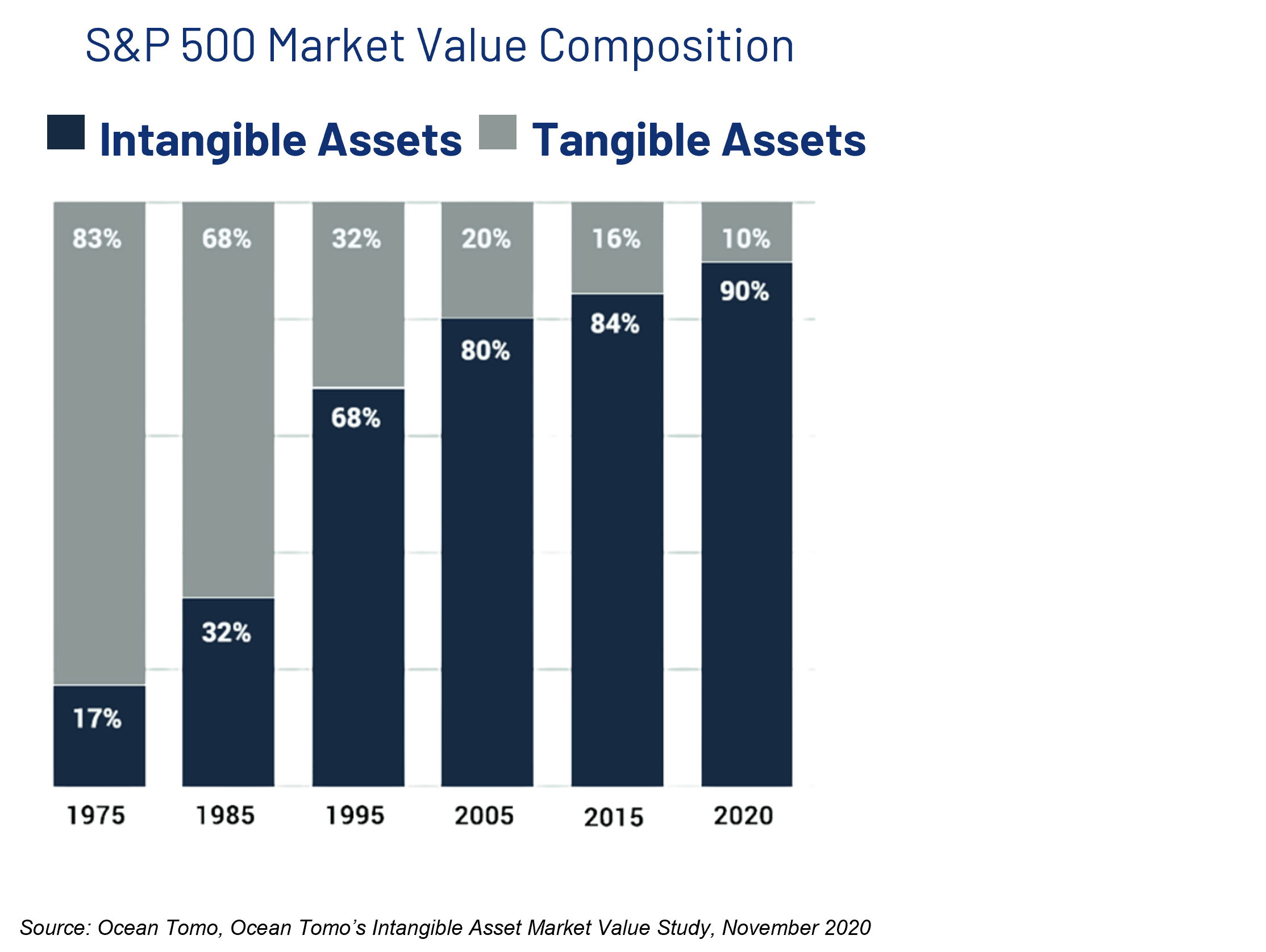

Financial analysts were interested in evaluating the impact of cultural influence and sustainability practices on corporations over time, specifically in regard to the composition of the market value of the S&P 500. After studying five decades of data, analysts found a nearly inverse flip in the proportion of tangible versus intangible assets of S&P 500 companies.

In 1975, the market composition of the S&P 500 was made up of 83% tangible assets, and just 17% intangible assets. As the economy evolved and technology rose to become a dominant market within the S&P 500, the market composition changed to represent a whopping 90% intangible assets in 2020. Technology is not the sole driver of this change, as intangible assets have become critical to success: social media reputation, workforce retention, company culture, customer satisfaction, and company perception.

SASB Standards

The Sustainability Accounting Standards Board (SASB), is most commonly utilized by financial institutions, including asset managers, investment banks, and credit unions.

While you do not need to be a financial institution to utilize SASB ESG standards, they provide very clear direction on financial metrics to track and evaluate the performance of environmental practices.

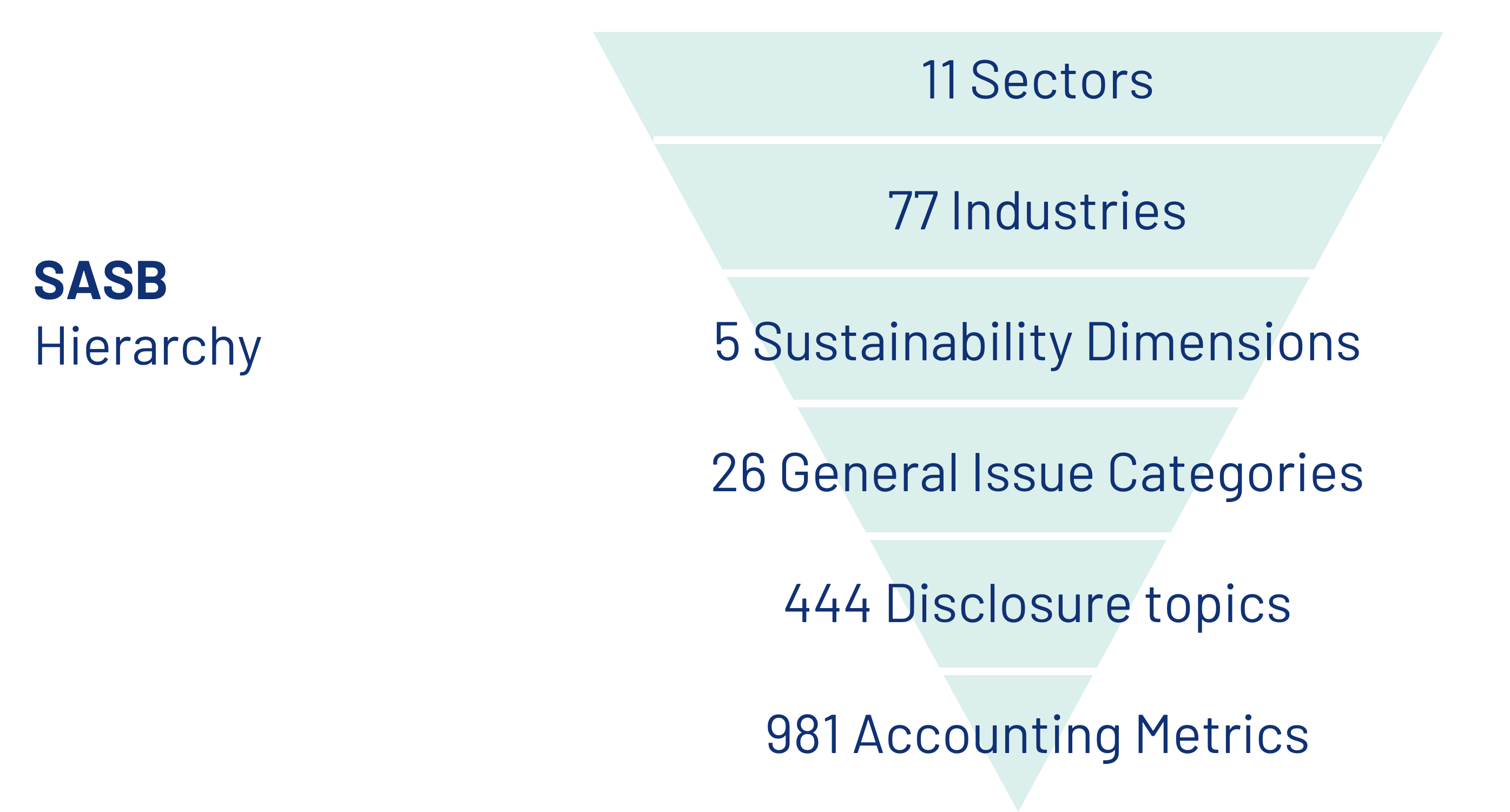

SASB hierarchy is comprised of sectors, industries, sustainability dimensions, general issues categories, disclosure topics, and accounting metrics.

SASB standards start with sectors or high-level categories then industries within those sectors. There are five sustainability dimensions that span every industry and sector (consider sustainability dimensions and the general applications for everyone). Beneath sustainability dimensions are general issue categories that represent individual material issues unique to each industry. There are five or six disclosure topics for each industry and one to three accounting metrics for each disclosure topic. Accounting metrics comprise 2,520 sub-metrics, 74% of which are quantitative.

As you can see, when using SASB standards the figures quickly add up regarding what you’ll need to track regarding environmental practices in your ESG program. When you’re serious about implementing environmental practices in your ESG program, it’s a good time to explore how technology can alleviate the burden of tracking plans, tactics, and metrics.

Easy ESG Tracking & Reporting

Learn how automation creates consistency and ease in ESG management

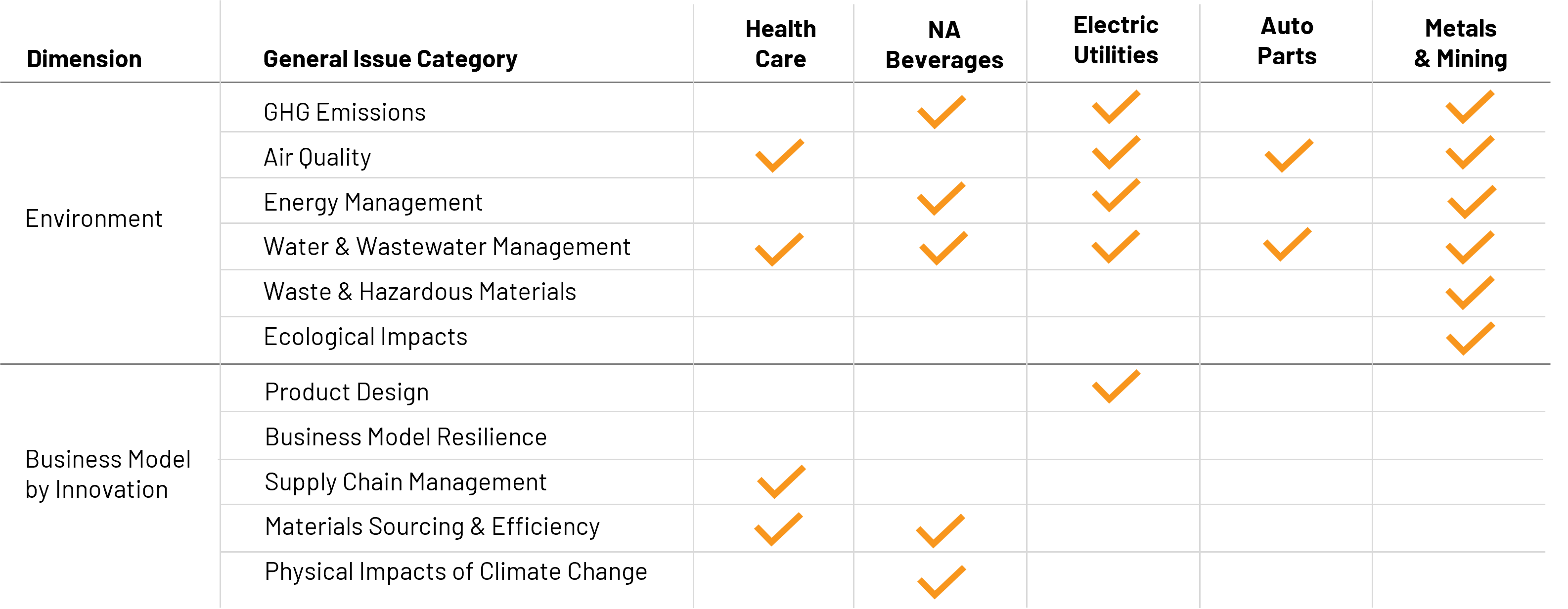

Here’s an example of how SASB sustainability dimensions and general issue categories apply across industries for environmental factors. You can see it is not a one size fits all approach. The expectations for tracking and reporting are heavy for metals and mining companies compared to healthcare delivery organizations.

SASB environmental standards example

Keep in mind, SASB offers guidelines, not requirements, so if your organization is just getting started in setting up environmental practices in an ESG program, use these categories for direction on where to start. What is right for your organization will come down to what aligns with your mission, stakeholders, employees, customers, and what you can afford to invest in both time and money.

TCFD Standards

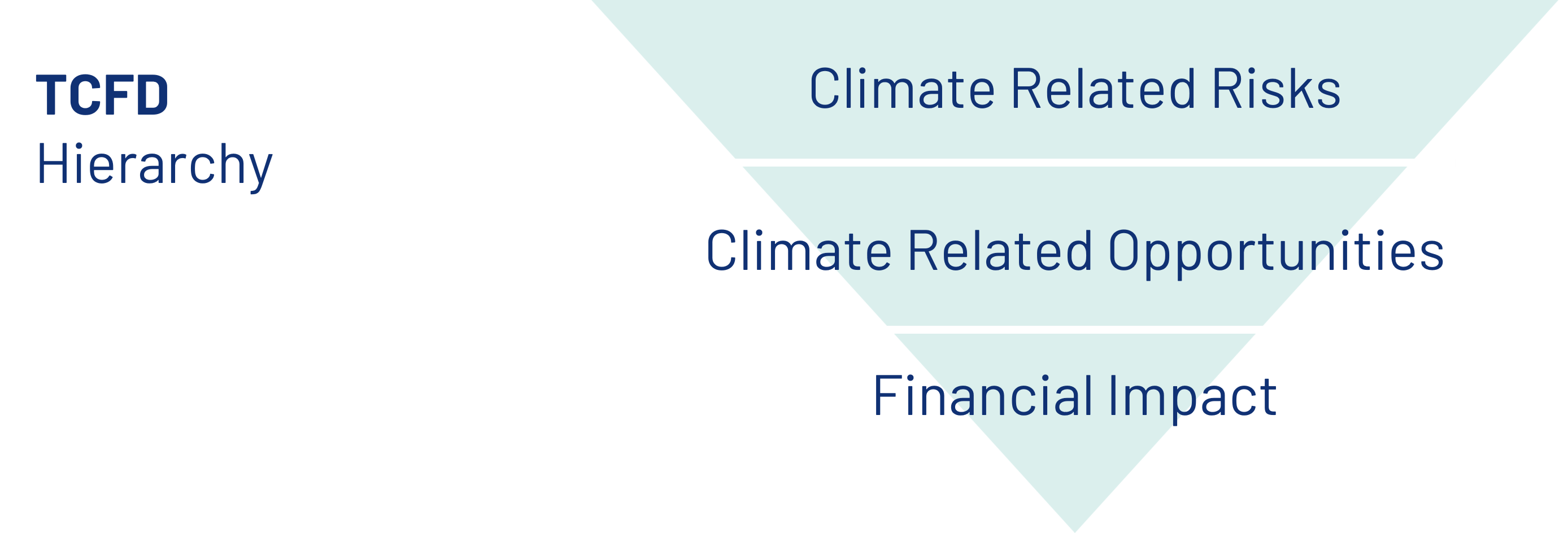

The Task Force on Climate-Related Financial Disclosures, or TCFD for short, is another commonly applied ESG standard. Similar to SASB, TCFD reviews the financial angle of climate risks; however, it is laser-focused on the financial impact of both climate-related risks and climate-related opportunities. TCFD is also unique from both SASB and GRI, because it is a rule and principle-based framework, whereas the SASB and GRI standards are simply rules-based.

Looking for ESG examples?

Explore best-in-class environmental practices from ESG leaders

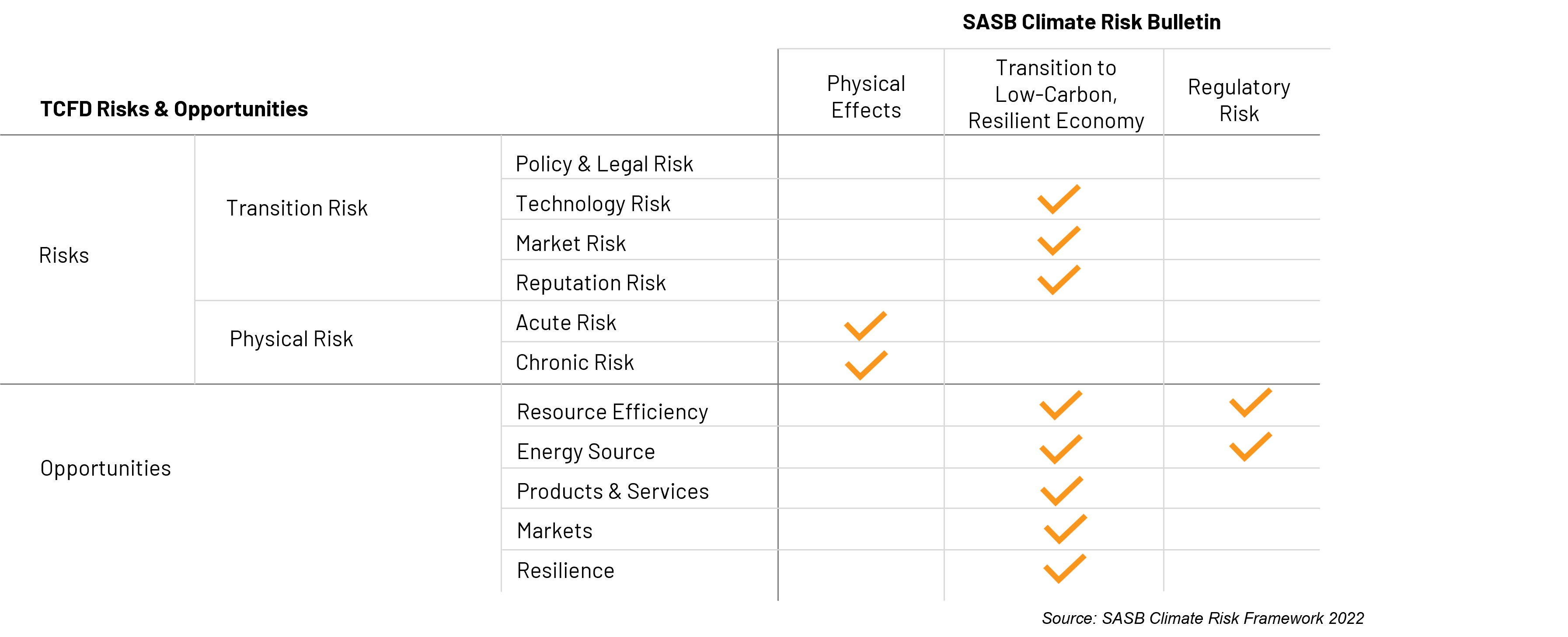

Within climate-related risks, the TCFD framework looks at the financial impact of both transition and physical risks.

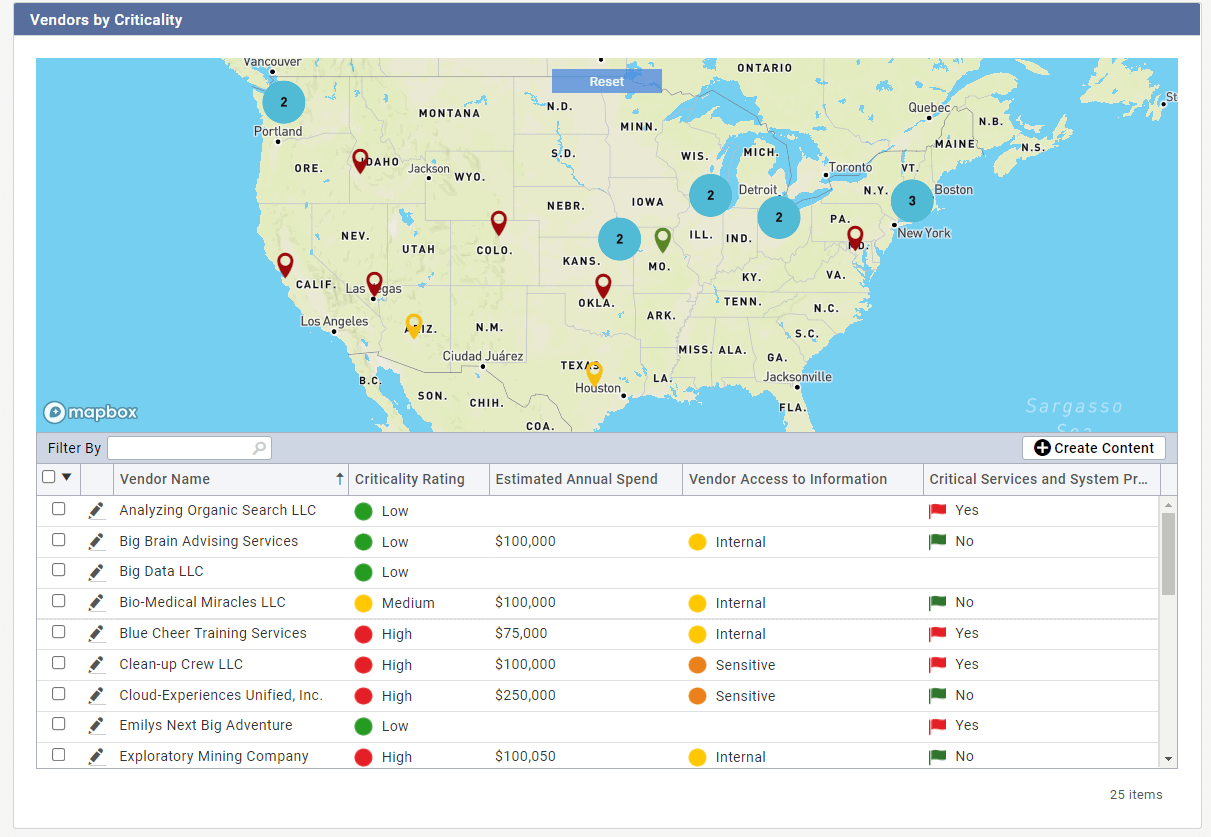

Physical risks include anything impacting your organization because of extreme weather events and rising sea levels. Having access to mapping technology that can plot your supplier, employee, and customers by location and risk level can help you identify the impact of physical risks to put together action plans.

Transition risks include anything your organization is actioning to take a more environmentally conscious approach to the business. This includes risks your organization incurs from changes in your internal policies or external laws and regulations. It also includes risks incurred by adopting new or switching to different technologies. And it also includes risks incurred from market changes or demand and the impact on your business’ reputation.

The second component of TCFD is in assessing climate-related opportunities. From this angle, you want to review every potential benefit from changes your business can take to improve your environmental impact.

Climate-related opportunities center around your organization’s ability to make better use of resources, including shifting to more efficient energy sources. It is also inclusive of business planning, meaning climate changes could generate ideas for new product lines or new markets to enter, or simply create a catalyst to improve resilience across your business.

Questions to ask yourself as you think through assessing climate-related risks and opportunities for your business:

- How can you take adjust your operations to transition to a lower carbon-emitting model?

- If changes require capital expenditures, how can those funds be offset by opening up new markets and opportunities?

- What would transitioning to a lower carbon-emitting model or a new product line means to your balance sheet and income statement?

TCFD provides a great catalyst to start a conversation with finance. Communicate with finance what changes are needed and work with them to finance projects or create pricing models for new markets.

One thing to keep in mind is that many of these frameworks are not in competition with one another. SASB and TCFD standards work together in many ways, as shown by the chart below that outline SASB disclosure topics as they intersect with corresponding risks and opportunities from TCFD.

Intersection of SASB & TCFD standards

GRI Standards

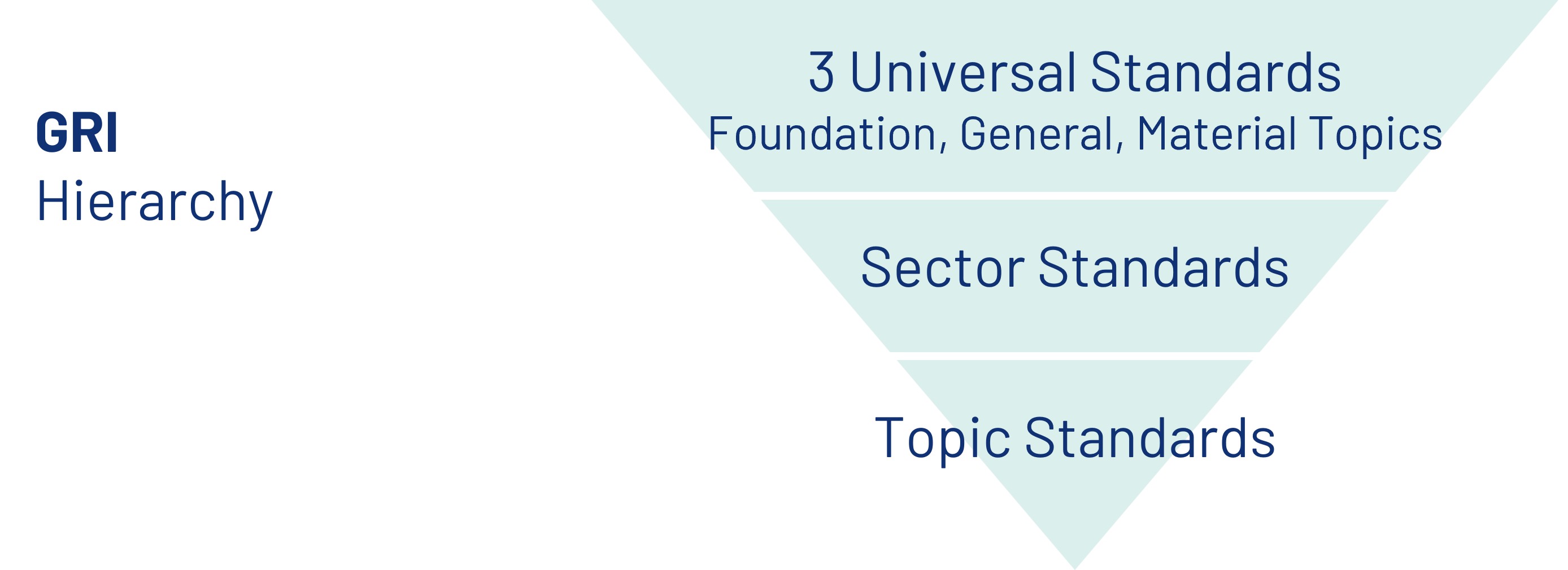

The other commonly used ESG standard is the Global Reporting Initiative (GRI). GRI breaks down the ESG hierarchy by universal standards, sector standards, and topic standards.

Three types of standards fall under GRI’s Universal top-level category: foundation, general, and material topics.

- Foundational standards specify any environmental requirements your organization would want to comply with.

- General standards contain the disclosures your organization would use to provide information on your environmental reporting practices (e.g., think governance and policies).

- Material Topic standards include environmental-specific elements that could have a material impact on your business.

The middle-tier of standards in the GRI hierarchy are Sector Standards. Sector standards are often the best place to start when determining specific environmental-related Material Topics for your organization. Run through the GRI list of Sector Standards to identify which apply to you that you’ll need to track, measure, and report on.

The lowest tier in the GRI hierarchy is made up of Topic Standards, which provide a more detailed level of disclosures necessary, including how your organization is managing your environmental practices and their individual impact.

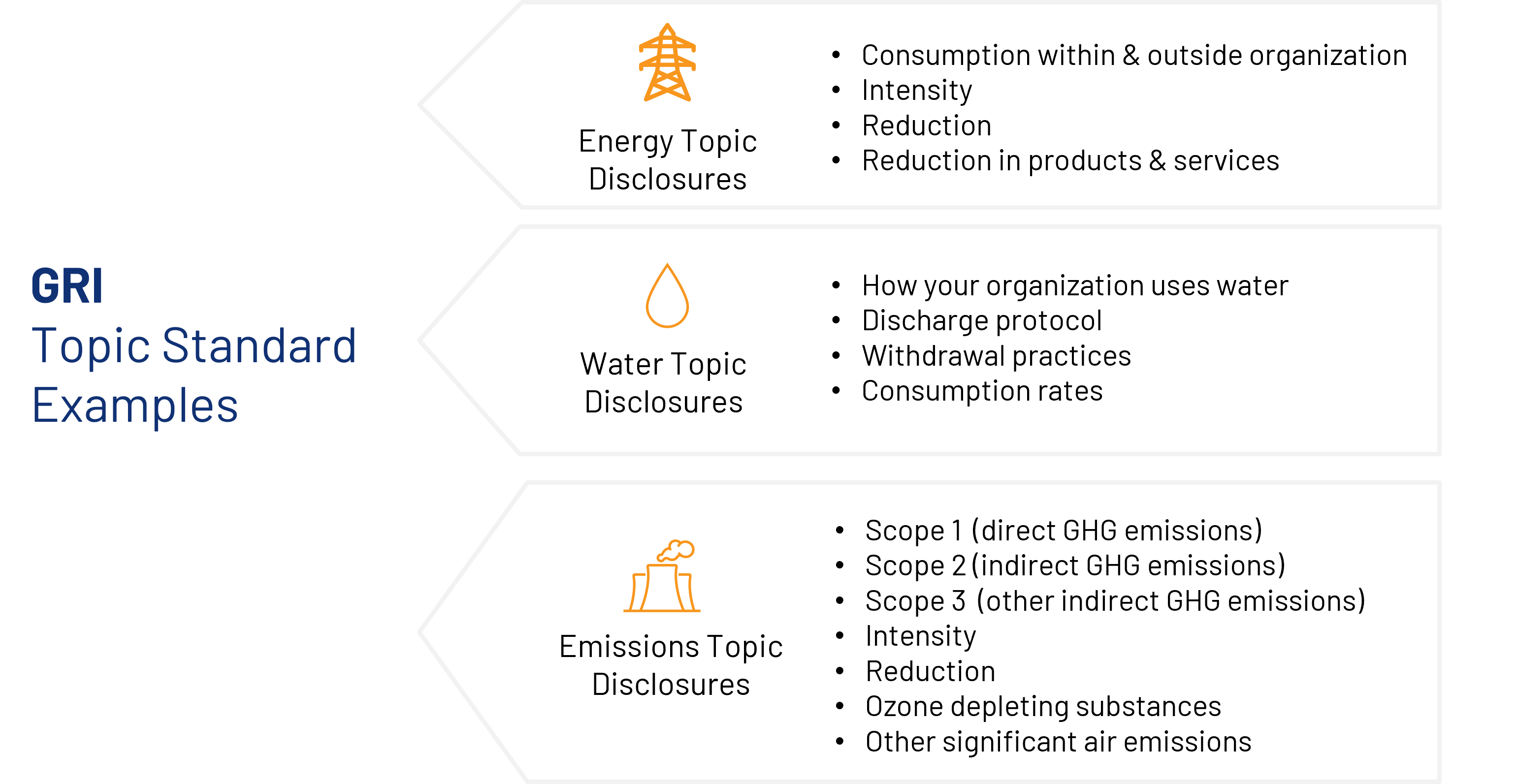

GRI examples

Here are a few examples of GRI topic standards specific to the environmental component of ESG. These three topics represent common starting points for corporations embarking on environmental impact initiatives: energy usage, water usage, and emissions.

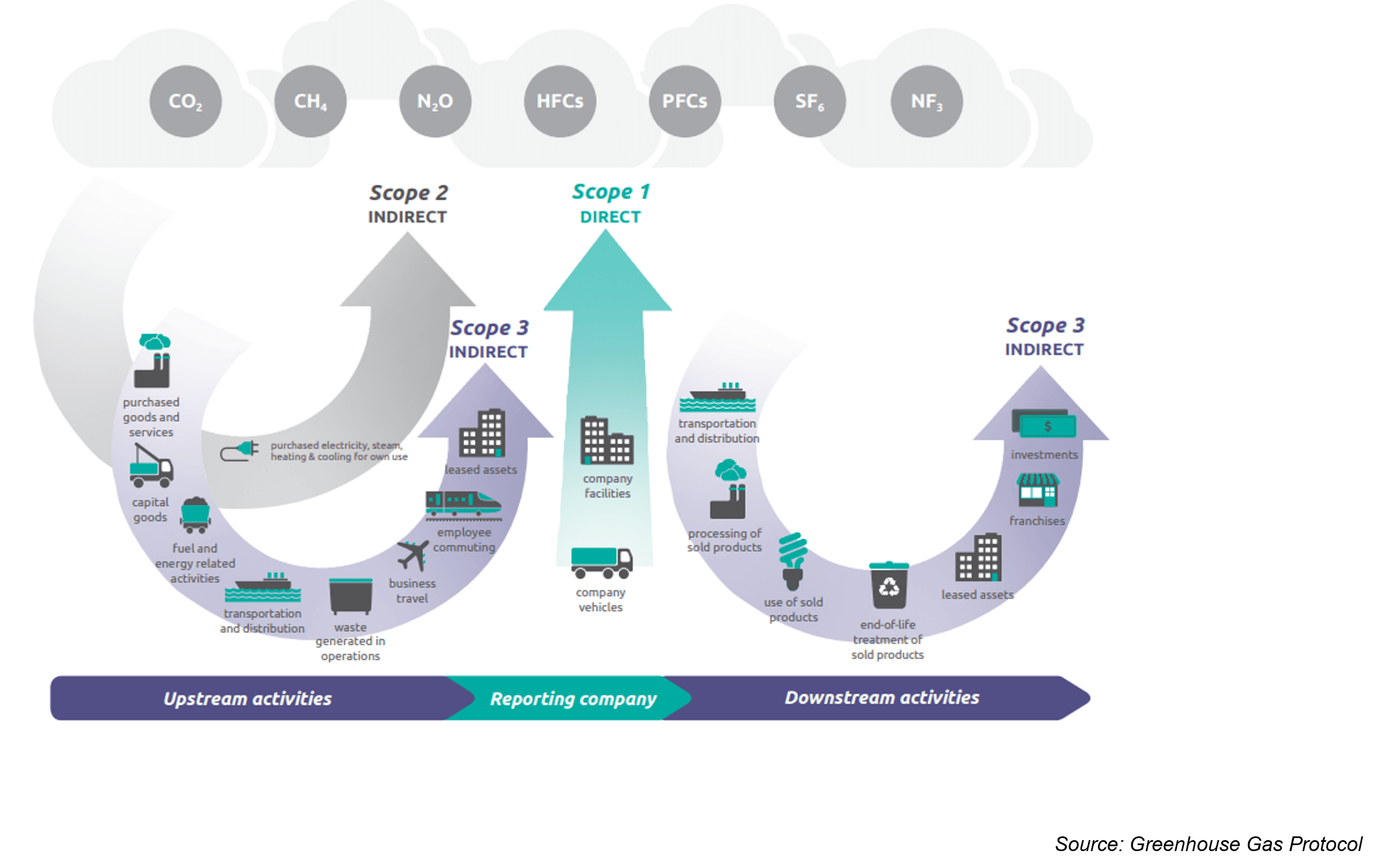

Let’s take a minute to unpack greenhouse gas emissions and what Scope 1, Scope 2, and Scope 3 mean under the environmental umbrella of ESG. Each of these Scopes categorizes the source of your emissions.

Scope 1 includes direct emissions from sources that your company owns and operates.

Example: Trucks deliver your products from your manufacturing plants or distribution centers. Emissions from those trucks, plants, and warehouses are included in your Scope 1 emissions count.

Scope 2 includes indirect emissions from your energy sources.

Example: Electricity, coal, steam, heating, cooling purchased for use by your company. Emissions from those origination sources are included in your Scope 2 emissions count.

Scope 3 includes indirect emissions from any non-energy sources.

Example: Business travel is a common example in Scope 3. Emissions from flights, taxis, and hotel stays are included in your Scope 3 emissions count.

SASB vs. TCFD vs. GRI for Your Environmental Practices

GRI is similar to SASB in that both break down standards by sector and industry, while simultaneously providing general applications that are similar across all industries. Choosing the preferred standard to devise the social strategy in your ESG program is like choosing whether you’ll follow: agile or ITIL IT development processes.

Go with the standard that best aligns with how your business operates and makes decisions.

Once you establish whether your organization will follow a specific ESG standard or framework, your next step is to outline the specific social topics and disclosures your organization will focus on. With this shortlist, you’ll want to work through a detailed action plan to execute against the strategy for your ESG program.

This planning process entails documenting a detailed social approach to governance, strategy, risk management, metrics and targets, and integration across your business.

Build an Environmental Roadmap for ESG

Check out the step-by-step guide to focus your environmental strategy in an ESG program

More Reading to Check Out

Onspring Announces Integration with Docusign

Complete signature workflows directly within the Onspring platform with the new Docusign integration.

Risk Control Matrix (RCM): Quick Guide to Building Business Resilience

A risk control matrix helps businesses identify, evaluate, and prioritize risks. Learn how this tool aids in resilience and continuity.

Quick Guide: SOC 2 Compliance Requirements

Discover how SOC 2 compliance aligns with the 5 Trust Services Criteria to enhance data security and operational excellence.